Working capital pressure tends to show up without much warning. A slow sales week, a sudden repair, or a vendor who wants payment a bit earlier than planned can put stress on everyday operations. In moments like these, some companies look at faster funding sources to stay steady. An MCA advance has gained traction for exactly that reason. It moves money quickly and gives business owners a chance to catch up before the pressure grows. Many owners exploring MCA business options want to understand the real cost before they step in. This article breaks down the positives and negatives in a clear manner so readers can judge whether an MCA advance works for their situation or not.

What an MCA Advance Really Means

An MCA advance is a small business financing option where the provider purchases a percentage of future sales and, in return, gives an upfront sum. Payment usually comes through daily or weekly remittances tied to revenue volume. There is no fixed schedule in the traditional sense. If sales dip, the remittance adjusts downward. Many small companies use this approach when they want to bridge gaps quickly. MCA business users often include restaurants, retail stores, and service operations that generate consistent card-based revenue. The structure is simple, but the financial impact needs to be weighed carefully.

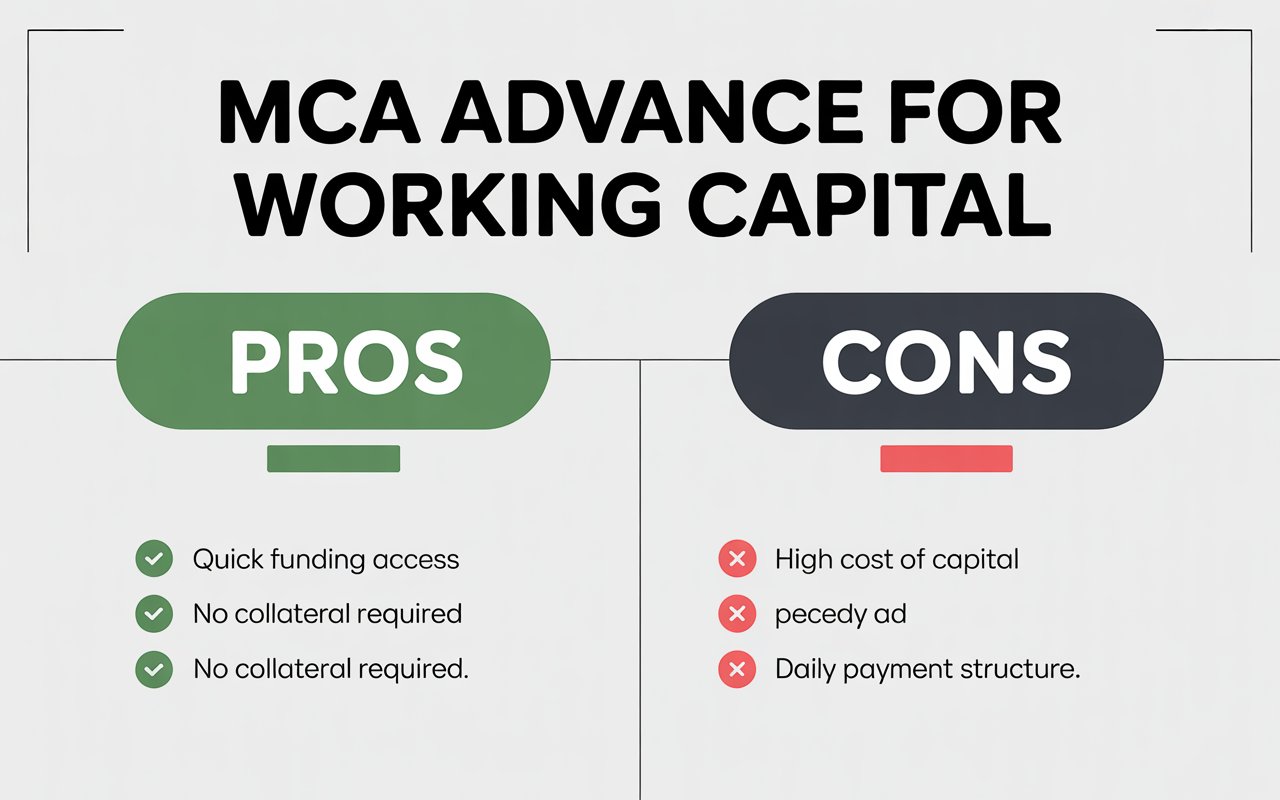

Pros of Taking an MCA Advance for Working Capital

-

Fast access to capital

Speed is the biggest appeal. Many companies receive funds in 24 to 48 hours. Some even quicker. When a business owner is staring at a broken refrigerator in a restaurant or urgent payroll concerns, that speed creates real breathing room. Situations like this make an MCA advance attractive. It solves a problem before the problem spreads into other areas.

-

Flexible repayment structure

Repayments move with sales. Higher sales mean higher remittances. Slow days bring lower remittances. This helps companies avoid rigid payment cycles that feel out of sync with day-to-day operations. It is one of the main reasons companies return to an MCA advance after using it once. There is less fear of missing a fixed monthly due date, especially in seasonal sectors.

-

Minimal documentation

Traditional loans often involve tax returns, financial statements, credit review, and long application lines. MCA lenders usually keep documentation simple. They ask for business bank statements and basic revenue information. That simplicity helps companies that are emerging, rebuilding, or currently unable to meet bank standards. Sometimes simplicity has its own value, especially when time is tight.

-

Useful for businesses with uneven revenue

A company with fluctuating sales can feel pressure during its down cycles. An MCA advance helps balance those ups and downs. Seasonal retail stores, food service businesses, and others with changing demand often use it as a short runway before their busy period arrives. This is why many MCA business borrowers continue exploring the option each year during peak seasons.

Cons of Taking an MCA Advance for Working Capital

-

Higher overall cost

The biggest drawback relates to cost. MCA advances use factor rates instead of typical interest, and the total repayment amount can be significantly higher. Owners sometimes underestimate this number and then feel the pinch later. It is important to calculate the full amount that must be repaid, not only the speed at which funds arrive.

-

Daily or weekly repayment pressure

Daily or weekly withdrawals can feel intense if sales fall behind expectations. Even though the amount adjusts, the frequency itself may create tension inside cash flow planning. For some companies, that constant movement of money out of the account becomes a major concern. An MCA advance requires a tight eye on incoming sales at all times.

-

Short repayment horizon

Most MCA advances are repaid within a few months. Short terms offer quick relief but also force quick turnaround. A business that needs longer recovery time may struggle with this speed. It works best for companies that are expecting revenue growth soon or have predictable inflows. MCA lenders usually explain these terms up front, but the responsibility to manage the pace sits with the business.

-

Impact on operational planning

Frequent remittances may affect vendor payments or inventory cycles. A business aims to balance every outgoing dollar. When a daily withdrawal is part of the picture, planning becomes even more essential. Business owners sometimes experience circumstances where they must choose between paying a supplier or covering the next remittance. These situations can create stress that needs to be addressed before signing for an MCA advance.

How to Know if an MCA Advance Works for Your Company

An MCA advance is often availed by businesses with strong sales but temporary cash gaps. It may make sense when a business needs short-term working capital and expects revenue stability ahead. Companies with lower margins, unpredictable demand, or long-term financing needs should think through the choice even more. Comparing offers from different MCA lenders can open a business owner’s eyes to how much the cost or repayment setup can shift from one provider to another. It is interesting how two offers that look similar at first can feel very different once the numbers are laid out. Some owners discover that an MCA business option fits their immediate cash needs and gives them enough room to operate without worry. Others look at the final repayment amount and decide it does not line up with where they want their company heading. The gap between those two reactions is pretty common, which is why a careful review usually pays off.

Conclusion

An MCA advance often steps in when a business is dealing with one of those tight financial moments that show up out of nowhere. It brings quick relief and helps keep things running, which matters a lot when timing feels a bit too close for comfort. Still, that speed comes with a repayment rhythm that can feel intense if it is not tracked carefully. So it becomes a balancing act. Owners look at the fast access, then look again at the cost, and try to figure out what feels right for their situation. Once both sides are clear in their mind, the decision usually becomes easier. Some companies find that an MCA advance strengthens their working capital. Others realize it adds more pressure than expected. Understanding the trade-offs makes the whole choice less confusing.